This Diwali, the Government of India has just launched its Sovereign Gold Bonds. It seems like a ‘Not to miss opportunity’. Here are some of the key features and benefits of these bonds.

Sovereign Gold Bonds

Features:

- The Bonds are denominated in ‘Grams of Gold’ rather than in Rupees. What that means is that the Investor owns a fixed quantity of gold, which he will get on maturity.

- The Maturity date is 8 years from allotment. But Investors have the right to redeem it (Put Option) after the 5th year.

- The Bonds will be listed on stock exchanges. Hence, they will be liquid investments and an Investor can sell them in the market anytime.

- The bonds carry an annual interest of 2.75% on the initial investment amount.

There seem to be many benefits to these bonds at first glance. I have listed some of them below.

Benefits:

- You hold gold in Demat Form. Hence, there is no risk of theft or loss.

- Since this is not physical gold, there is no dispute about its purity and no loss in value when selling it (unlike the standard 5% mark down that jewellers make to account for impurity).

- When you hold physical gold with yourself, you do not earn any ‘interest’ on it. Here, you earn a 2.75% interest on the gold, because you have given that gold to the Government of India as a loan. This interest earned is in addition to the upside that you get on increase in gold prices.

Seems fantastic, right? At first glance, it did to me as well. But behind all this, there is one key variable. That is that you are still taking a punt on gold prices. So, for you to really earn a good return on it, gold prices need to go up.

This got me thinking – would gold prices go up in the future? Or rather, by how much do gold prices need to rise, for an Investor to make a decent return?

Let’s assume that an investor needs a pre-tax return of 7.70%. This is the current yield on a 10 year Government of India bond. The return on the gold bond can be broken up into the following sub-components.

Interest Amount + INR Depreciation v/s USD + International Gold price movement (in USD).

The first component, which is the Interest Amount, is fixed at 2.75%.

INR Depreciates against the US Dollar, because the Reserve Bank of India’s Printing presses work faster than the US Federal Reserve’s Printing presses. As per purchasing power parity theory, the depreciation of INR vs USD should be equal to the difference between the price inflation in the two economies. Over the past 7 years (2008-2015), INR has depreciated against the USD by an average of 7% every year. This was a period of very high inflation in India. The average CPI inflation during this period ranged from 8% to 10%. The US Federal Reserve on the other hand has an inflation targeting policy of 2%, and actual inflation in the US has ranged from 0% to 3% over the same period.

The RBI has now adopted a stricter Inflation targeting policy, with an inflation target of 6%. The USA on the other hand may see actual inflation of around 1% to 2% for the next few years. Thus, we can expect the INR depreciation against the USD to be around 4% to 5% over the next 5 to 8 years (tenure of the Gold Bonds in question).

If we plug these variables in our equation, we arrive at the following relationship.

2.75% (Interest Amount) + 5% (INR Depreciation v/s USD) + International Gold price movement = 7.70% (Expected Return on Gold Bonds)

What this means is that as long as International Gold prices do not fall over a 5 to 8 year period, an Investor should be able to achieve a good enough return. Sounds irresistible, doesn’t it?

International Gold Prices

But let’s not jump to conclusions just yet. Let’s analyse International Gold Prices. Over a long period of time, international gold prices are driven by one single factor – Money Supply. The more money that a central bank releases into the economy, the higher gold prices go. But how sacrosanct is this relationship? How immediately do gold prices respond to a large fund infusion or a large fund contraction in the economy? These are some of the things worth looking at before we can come to any meaningful judgement on where gold prices are headed.

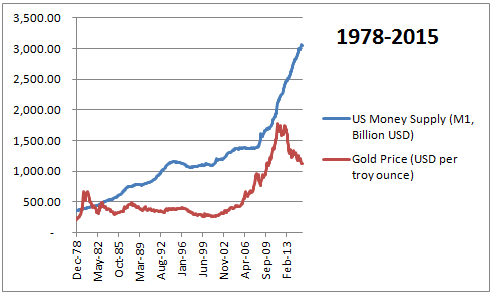

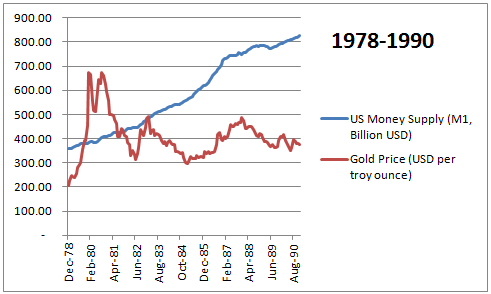

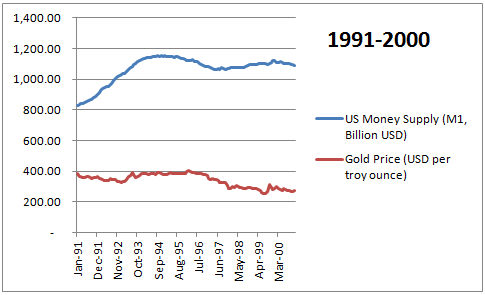

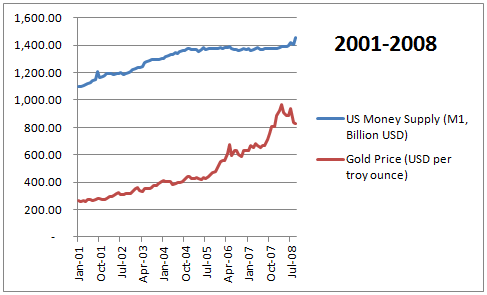

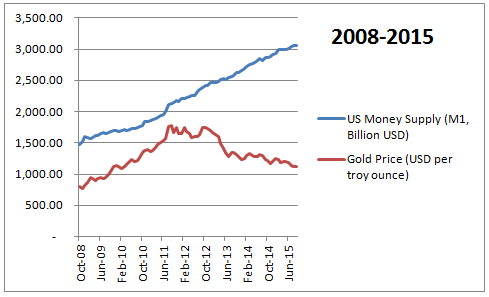

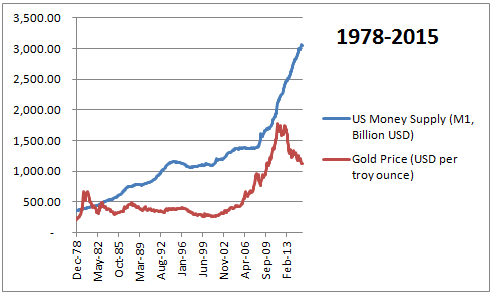

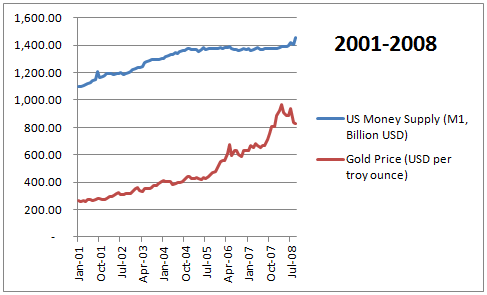

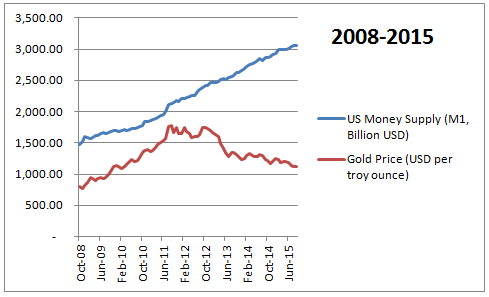

Below Charts show Money Supply (M1) and Gold Prices in the US over various periods of time. We should ideally consider global money supply – or at least that of the largest economies taken together. But I’ve been a bit lazy and considered only the US money supply, as it is the single largest factor in global monetary economics.

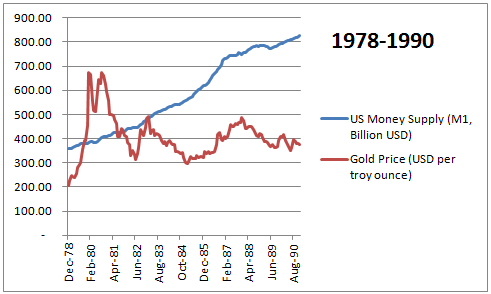

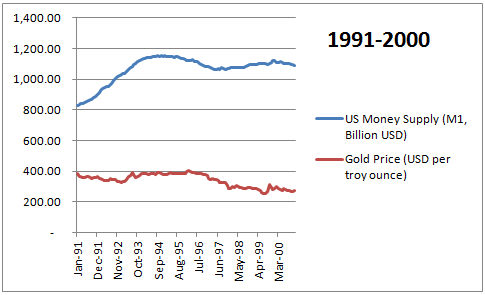

As we can observe, gold prices remained relatively range bound over a long period from 1978 to 2002, while US money supply continued to increase. Post this, gold prices started increasing rapidly for a few years, but then started crashing again. All this, while the Fed has pumped money into the economy at one of the fastest pace ever observed in history. This seems intriguing. Let’s break up this 37 year period into smaller time frames and analyse further.

While there is a definite relationship between gold prices and money supply it is not a direct relationship. There is another factor at play.

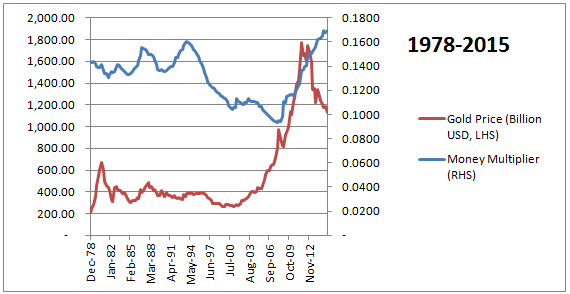

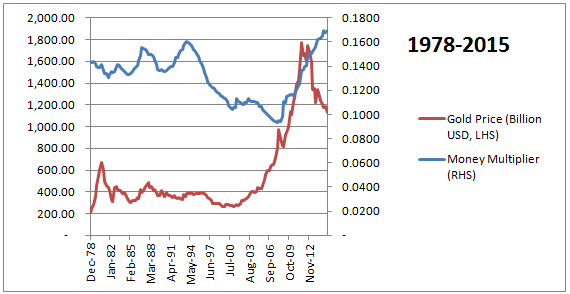

After a little bit of thought, I’ve come up with one hypothesis. Gold price inflation happens when the availability of funds in an economy, exceeds the requirement of funds of that economy. Hence, the nominal GDP has to be taken into account. What we really need to look at is the money supply per unit of GDP v/s gold prices. I’m calling the Money Supply per unit of GDP as the ‘Money Multiplier’. Now, the higher the money multiplier, the higher should gold prices be. We look at this relationship in the below table.

As we can see, there was a substantial drop in the money multiplier from 1993 to 2005, without any corresponding decline in Gold Prices. However, Gold Prices have substantially shot up after that, when quantitative easing led to an increase in money multiplier back from 0.10 to 0.16 levels. There’s a logical reason to this.

Electronic transactions became extremely popular from the 1990s onwards. This led to a declining requirement of cash in the economy. And hence, even with a declining money multiplier, gold prices did not deflate. But when the Fed started its quantitative easing programme, and pumped cash into the economy post 2008, gold prices shot up immediately.

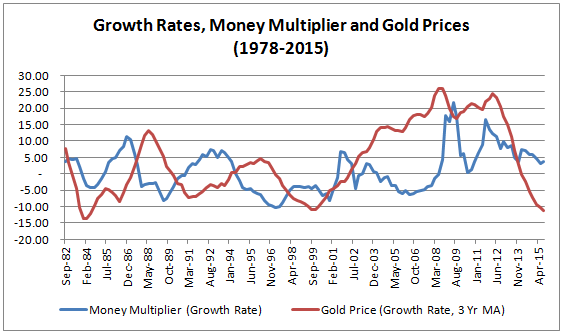

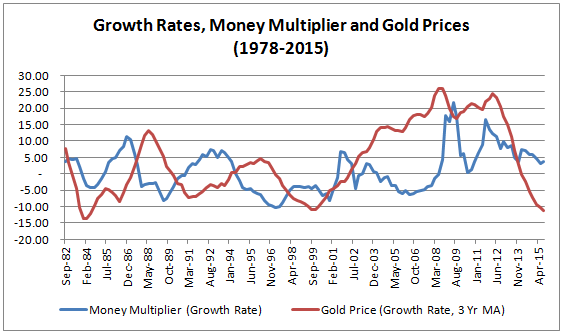

In the below table, I’ve looked at the ‘Y-o-Y Growth rates’ in Gold Prices and Money Multiplier. It gives an idea of the actual directional response of one variable to another.

If we look at the period from 1982 to 1998, the directional response of gold price to money multiplier is almost identical, with a lag of 2-3 years. The trends after this are unclear. But I’m still inclined to believe that there is a positive directional relationship between the two and this will continue into the future.

Conclusion

So, what conclusions can we draw from all this analysis?

- Gold prices have crashed over the past 2-3 years, in anticipation of an end to quantitative easing in the US.

- With money supply expected to remain tight over the next few years, there is almost negligible scope for gold prices to start rising again.

- What we might see is some more decline and then some stability in gold prices. We are not in a position to forecast the extent of such decline or the levels at which gold prices will stabilize.

As discussed earlier, we need international gold prices to at least remain stable for the Gold Bonds to be attractive. This means that I would be comfortable investing in the bonds if I could expect a combination of increasing and stable gold prices. But according to our analysis, we are actually expecting a combination of stable or declining gold prices in the next few years.

Hence, I feel that it is best to give the Gold Bonds a miss.